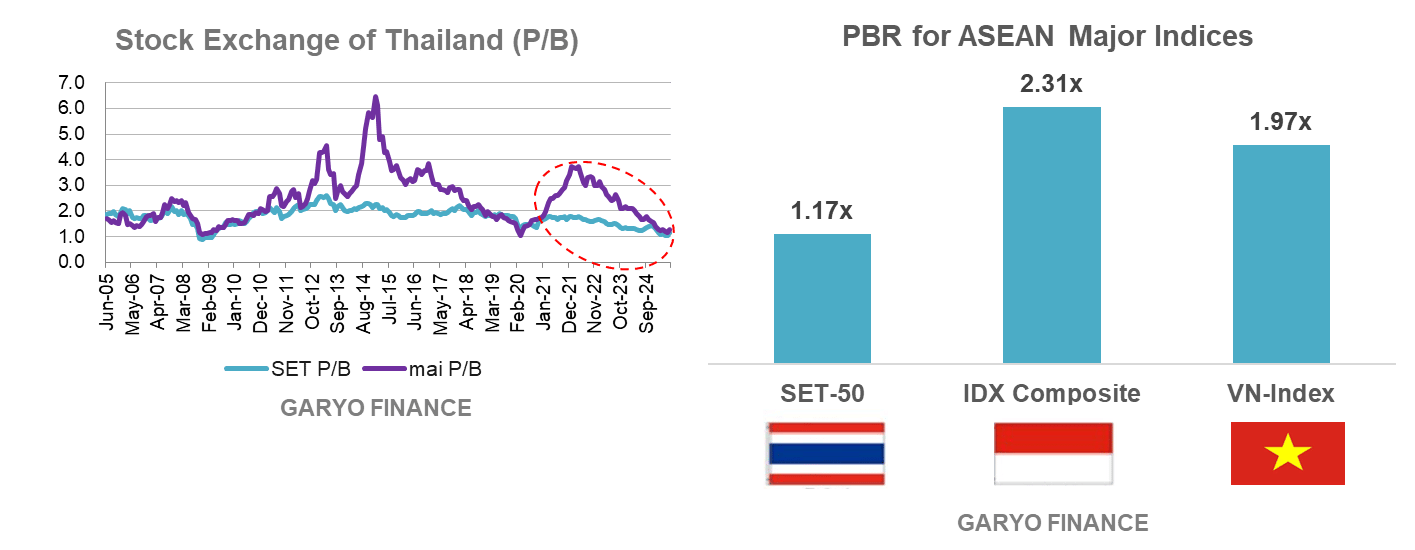

Thailand’s stock market has long been considered “cheap.” But today’s discount is no longer cyclical — it has become structural. The SET index trades at just 1.0x book value, the lowest in decades, compared with around 2.0x in Vietnam and more than 2.3x in Indonesia.

On paper, dividend yields above 4% should be a draw. In practice, international investors remain unconvinced.

Thailand’s valuation has diverged sharply from peers. Despite steady dividends, the SET trades near 1.0x P/B, far below regional benchmarks.

What’s Driving the Discount?

Balance sheet stress

Our dataset shows only ~16% of large Thai corporates are in net cash positions. The majority are leveraged, with typical debt-to-equity ratios of 0.9–1.2x and interest-bearing debt near 4x EBITDA. These thinner cushions make investors discount resilience.

Fragile cash generation

Since 2022, working capital cycles have lengthened by an average of nine days for large caps. Property developers are particularly exposed, as tight liquidity reduces their ability to service debt and reinvest in growth.

Shareholder returns that erode trust

Buybacks — common in global markets — are rare in Thailand. Dividends remain the default, but payouts often exceed both earnings and operating cash flow. This mismatch undermines credibility and signals weak capital discipline.

Why It Matters

■Question for you: Do you think Thai corporates should use buybacks more often? Hit reply — I’ll feature select views in a future issue.

Global investors benchmark Thai equities against U.S. Treasuries yielding 4–5%, not local government bonds at ~3%. Against that comparison, Thailand’s 4% dividend yield looks less compelling once governance and payout discipline are factored in.

Portfolio flows show the result: since the pandemic, foreign investors have steadily pulled back from Thai equities while maintaining positions elsewhere in ASEAN. Unless Thai corporates and policymakers act, this discount will persist.

Where Next

Thailand does not need a miracle, but it does need reform.

Tie payouts to cash: dividends should align with actual cash generation, not headline optics.

Consider buybacks selectively: sparing but transparent buybacks would signal management confidence in undervaluation.

Strengthen communication: boards should publish clear targets for leverage, coverage, and capital allocation, with regular progress updates.

Policy support: regulators and the exchange can encourage best practices by improving disclosure standards and enabling modern buyback frameworks.

With disciplined payouts, stronger balance sheets, and credible communication, Thai corporates could reclaim investor trust. Without reform, the valuation divide across ASEAN will only widen.

Coming Up Next

In the next issue, I’ll explore the SET-50 payout puzzle — identifying which companies can truly afford their dividends and which are stretching beyond their cash flow capacity. Expect clear visuals mapping payout ratios against operating cash flow coverage.

Want deeper insights? You’re already on the free list — I’ll notify you first when premium launches, with early-bird perks for founding subscribers.

SET-50 dashboards tracking payout coverage, leverage ladders, and cash conversion cycles

Sector scorecards comparing ROIC vs WACC spreads

Download-ready charts designed for CIOs and CFOs

I’ll notify you when premium goes live — so you can be first to access the deeper datasets.

I’d love to hear your thoughts — feel free to simply hit “reply” to this email with any feedback.

Dai Kadomae, CFA, CPA

GARYO FINANCE | LinkedIn